Via CNBC (February 18, 2021) — When the pandemic first slammed the country last March, Iya Karade was one of countless small-business owners who had to shut their doors.

Her Orange, New Jersey-based gymnastics studio, Athletic Arts Academy, didn’t reopen until July — and then, it was only at 25% capacity.

“The word pivot became synonymous with survival,” said Karade, 54, who started her business in 2014 in the hopes of bringing gymnastics to kids in her urban area.

That meant conducting virtual classes and, once she did reopen, adding skateboarding and roller skating to her offerings.

She is still at 25% capacity since many families are staying home, may be afraid to come or live in multi-generational households — which means they have to be careful of putting older relatives in harm’s way.

Whether she can survive another year under these conditions depends on many variables, such as the flexibility of her landlord.

“It depends on me getting more funding,” Karade said.

Almost a year into the pandemic, many businesses, especially Black-owned ones, are trying to stay afloat.

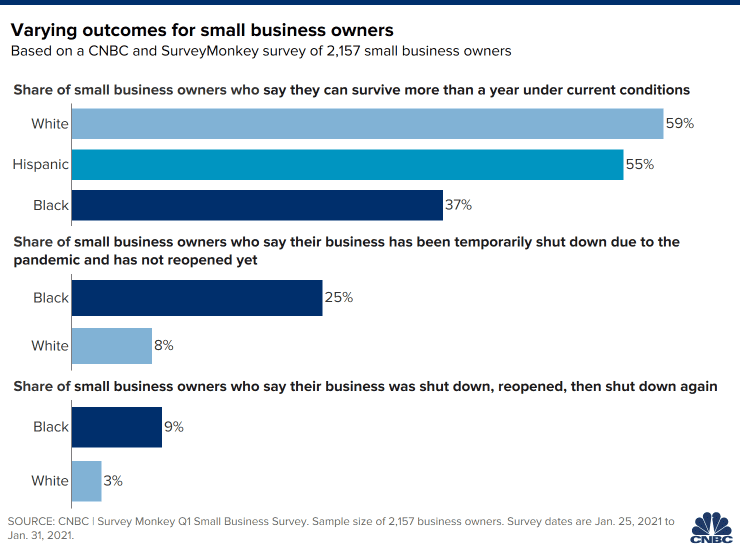

About one-third, or 37%, of Black small-business owners said they can survive more than a year under current conditions, versus 59% of White small-business owners and 55% of Hispanic small-business owners, according to the latest quarterly CNBC | SurveyMonkey Small Business Survey.

Additionally, 15% said their business has been temporarily shuttered due to the pandemic and has not reopened yet. In comparison, 8% of White small-business owners reported the same. The survey was conducted Jan. 25-31 using the SurveyMonkey platform and included responses from just over 2,100 small-business owners across the country.